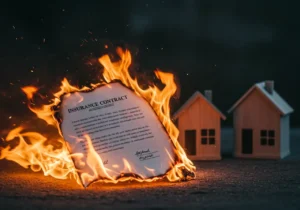

As California enters 2025, the state finds itself grappling with an escalating wildfire insurance crisis. With the frequency and severity of wildfires increasing, the insurance market is under immense strain, leading to skyrocketing premiums, policy cancellations, and limited coverage options for homeowners in high-risk areas. In this blog post, we explore the factors driving this crisis, its effects on homeowners, and the actions being taken by the state to mitigate the impact on residents and businesses.

The Growing Threat of Wildfires

California’s landscape has long been vulnerable to wildfires, but the risk has intensified in recent years. The 2025 wildfire season is among the most devastating on record, with fires like the Palisades Fire in Los Angeles County and the Eaton Fire in the Sierra Nevada causing widespread destruction. According to the California Department of Forestry and Fire Protection (CAL FIRE), the fires of 2025 destroyed more than 16,000 structures, leaving thousands of homeowners without shelter, and resulted in insured losses estimated at $28 billion. These fires are not outliers; they are part of a larger trend that is expected to continue as climate change exacerbates droughts and other environmental factors contributing to fire risks.

California’s landscape has long been vulnerable to wildfires, but the risk has intensified in recent years. The 2025 wildfire season is among the most devastating on record, with fires like the Palisades Fire in Los Angeles County and the Eaton Fire in the Sierra Nevada causing widespread destruction. According to the California Department of Forestry and Fire Protection (CAL FIRE), the fires of 2025 destroyed more than 16,000 structures, leaving thousands of homeowners without shelter, and resulted in insured losses estimated at $28 billion. These fires are not outliers; they are part of a larger trend that is expected to continue as climate change exacerbates droughts and other environmental factors contributing to fire risks.

The Strain on the Insurance Market

The growing number of wildfires has forced insurance companies to reassess the risks associated with insuring properties in California, particularly in wildfire-prone regions. As a result, many insurers are raising premiums significantly or pulling out of high-risk areas entirely. Some major insurers, including State Farm and Allstate, have either reduced coverage options or stopped writing new policies in areas most affected by wildfires. This has left homeowners in high-risk zones with fewer choices for coverage and higher costs for what coverage remains.

The increasing cost of insuring properties in these areas has led to significant market instability. The California FAIR Plan, the state’s insurer of last resort, has seen a dramatic rise in policyholders as private insurers have pulled back. However, the FAIR Plan is struggling to keep up with the demand for policies, and its coverage limits may not be sufficient to protect homeowners fully in the event of a catastrophic wildfire.

Rising Premiums and Policy Cancellations

Homeowners in wildfire-prone areas are facing a two-pronged problem: rising insurance premiums and the threat of policy cancellations. According to recent reports, some homeowners have seen their premiums increase by as much as 50% in a single year. In some cases, premiums have increased by even more, leaving homeowners struggling to afford the coverage they need to protect their properties. At the same time, many insurers are sending cancellation notices to homeowners in high-risk areas, particularly in rural communities or places near forests and dry brush.

For residents who rely on their insurance policies to protect their homes, these developments are alarming. In some cases, homeowners have been forced to turn to the FAIR Plan, which provides basic fire insurance coverage but has higher deductibles and lower coverage limits compared to private insurers. While the FAIR Plan offers a temporary solution, it is not a sustainable long-term option, and its rising costs present a further burden to homeowners.

State Actions to Address the Crisis

In response to the escalating insurance crisis, the California state government has taken several steps to stabilize the market and ensure that homeowners have access to affordable coverage. One of the most significant actions was the introduction of a series of emergency regulations aimed at addressing the challenges of the 2025 wildfire season. Governor Gavin Newsom signed an executive order that temporarily freezes certain rate increases and provides subsidies for homeowners at risk of losing coverage. These measures are designed to prevent a further erosion of the insurance market and ensure that families in wildfire-prone areas can still obtain protection.

Additionally, the California legislature passed Assembly Bill 226, which enables the FAIR Plan to issue bonds and increase its financial capacity to pay claims. This legislation aims to shore up the finances of the FAIR Plan, which has been struggling to keep up with the demand for policies. The state also plans to expand the use of catastrophe models that more accurately predict fire risk and adjust premiums accordingly. These models will help insurers better assess the risk of insuring properties and create more accurate pricing structures.

Long-Term Solutions: Wildfire Prevention and Mitigation

While the state’s emergency actions are helpful in the short term, addressing the wildfire insurance crisis will require long-term solutions focused on prevention and mitigation. One of the most critical aspects of mitigating wildfire risks is improving forest management practices, which can reduce the likelihood of large-scale fires. California has already started implementing controlled burns, clearing dead trees, and creating defensible space around communities to reduce fire risk. The state has also invested heavily in technology to detect fires early and respond more quickly, including the use of drones and satellite monitoring systems.

Moreover, building codes are being updated to include fire-resistant materials and better infrastructure for homes in wildfire zones. These changes aim to reduce the damage caused by wildfires and make it easier for insurers to provide coverage at a reasonable cost. The use of fire-resistant landscaping, such as drought-tolerant plants and defensible space around homes, is also being promoted as a way to further reduce risk.

The Role of Insurers in Addressing the Crisis

Insurers themselves have an important role to play in addressing the wildfire insurance crisis. While many companies are retreating from the market, others are starting to innovate with new products that cater to the unique challenges of insuring properties in high-risk wildfire areas. These products include policies that incorporate wildfire mitigation efforts into the pricing structure and reward homeowners for implementing fire prevention measures like installing fire-resistant roofs or creating defensible space.

Insurers themselves have an important role to play in addressing the wildfire insurance crisis. While many companies are retreating from the market, others are starting to innovate with new products that cater to the unique challenges of insuring properties in high-risk wildfire areas. These products include policies that incorporate wildfire mitigation efforts into the pricing structure and reward homeowners for implementing fire prevention measures like installing fire-resistant roofs or creating defensible space.

Some insurers are also exploring the use of technology to help mitigate wildfire risks. For example, smart home devices that detect smoke or heat can alert homeowners to fires before they spread, potentially saving lives and reducing the amount of damage caused. Similarly, insurance companies are using advanced data analytics to assess the risk of insuring individual properties, allowing them to offer more personalized pricing based on the specific risk factors of a home or neighborhood.

What Homeowners Can Do

While the state and insurers work to address the wildfire insurance crisis, homeowners in high-risk areas can take steps to protect themselves. These include:

- Reviewing and Updating Insurance Policies: Homeowners should review their insurance policies regularly to ensure that they have adequate coverage, particularly for wildfire damage. If insurance premiums are rising, it may be worth shopping around for better rates or considering the FAIR Plan as a temporary solution.

- Implementing Fire Prevention Measures: Homeowners can reduce their risk by creating defensible space, installing fire-resistant materials, and using fire-resistant landscaping. These measures not only help protect homes from fire damage but can also lower insurance premiums.

- Exploring Alternative Insurance Options: If private insurers are unwilling to provide coverage, homeowners should consider exploring options such as mutual insurance companies or joining community-based risk pools that offer coverage in high-risk areas.

Conclusion

The wildfire insurance crisis in California is a complex issue that requires a multifaceted approach. While short-term actions by the state and insurance companies are essential, long-term solutions focused on wildfire prevention, building resiliency, and promoting innovation within the insurance industry will be necessary to ensure that homeowners can access affordable and comprehensive coverage in the future. In the meantime, homeowners in high-risk areas should take steps to mitigate their risk and stay informed about changes in the insurance market.

For more insights into California’s wildfire challenges and other related topics, visit our Sustainable Insurance Strategy blog.